ADA Price Prediction: Technical Rebound Potential Meets Strong Fundamentals

#ADA

- Oversold Technical Conditions: ADA trading near Bollinger Band lower limit with improving MACD suggests near-term rebound potential

- Strong Fundamental Backdrop: 8-year development track record and new roadmap provide long-term value support

- Institutional Accumulation: Whale buying activity indicates smart money confidence despite short-term price weakness

ADA Price Prediction

ADA Technical Analysis: Oversold Conditions Signal Potential Rebound

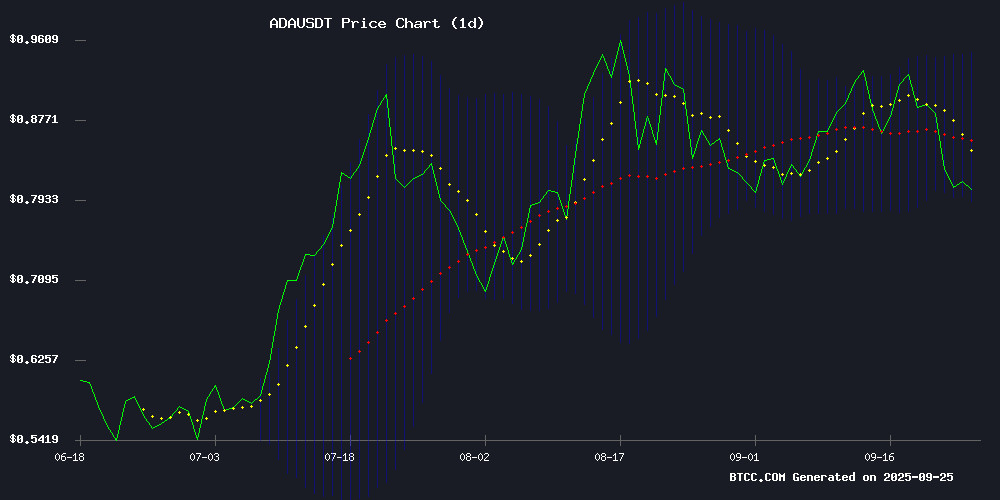

ADA currently trades at $0.8042, below its 20-day moving average of $0.8698, indicating short-term bearish pressure. However, technical indicators suggest potential reversal opportunities. The MACD shows a positive divergence with the histogram at 0.0168, signaling weakening downward momentum. Bollinger Bands position ADA NEAR the lower band at $0.7915, typically indicating oversold conditions that often precede price recoveries.

According to BTCC financial analyst Mia, 'The current technical setup suggests ADA is testing key support levels. The oversold readings combined with MACD improvement could fuel a rebound toward the middle Bollinger Band around $0.87 if buying pressure emerges.'

Market Sentiment: Short-Term Weakness Masks Strong Fundamentals

Recent Cardano developments create a mixed but ultimately positive sentiment landscape. While short-term price action shows weakness, the ecosystem celebrates 8 years of robust development activity and has unveiled an ambitious 2025-26 roadmap. Whale accumulation behavior indicates smart money positioning for potential recovery.

BTCC financial analyst Mia notes, 'The fundamental story remains compelling despite technical weakness. Whale accumulation countering selling pressure, combined with strong development activity, suggests institutional confidence in Cardano's long-term value proposition. The roadmap unveiling could catalyze renewed interest once market sentiment improves.'

Factors Influencing ADA's Price

Cardano (ADA) Shows Oversold Signals Amid Short-Term Weakness, Long-Term Fundamentals Remain Strong

Cardano's ADA token dipped 1.38% to $0.816, trading below key moving averages but maintaining support above its 200-day level at $0.735. Technical indicators flash oversold signals, with the RSI at 36.6 and Stochastic RSI NEAR zero, suggesting potential for a short-term rebound despite persistent downward pressure.

Longer-term prospects appear brighter as Cardano ETF approval odds rise to 9%, potentially unlocking institutional demand. The Cardano Foundation's roadmap emphasizes DeFi and ecosystem growth, while whale activity and corporate treasury adoption by firms like Reliance Global signal growing confidence in the protocol's future.

Cardano Marks 8 Years with Surging Activity and Development

Cardano celebrates its eighth anniversary amid a surge in on-chain activity and developer engagement. The blockchain, now a hub for decentralized applications and smart contracts, continues to expand its ecosystem despite its decade-long presence.

Peer-reviewed innovation and a focus on reliability have defined Cardano's journey from whitepaper to global platform. Analysts suggest the network is poised for its strongest year yet, with scalability and governance upgrades driving momentum.

Cardano Whales Counterbalance Selling Pressure as ADA Faces Potential 14% Decline

Cardano's price shows signs of vulnerability, with analysts predicting a 14% downturn as long-term holders offload their holdings. On-chain data reveals a two-month high in selling activity from this typically steadfast cohort, signaling eroding confidence in ADA's near-term prospects.

Whale activity tells a different story. Entities holding between 100 million and 1 billion ADA have accumulated over 460 million tokens worth $375 million in just three days. This aggressive accumulation suggests institutional players see value at current levels, creating a potential floor under prices.

The standoff between nervous retail investors and deep-pocketed whales highlights Cardano's current crossroads. While technical indicators point to further downside, the whale buying spree demonstrates strong conviction in ADA's long-term fundamentals.

Cardano Whales Accumulate as Traders Bet on Key Support Holding

Cardano (ADA) is showing signs of resilient demand after a 69.2 million ADA whale transfer from Coinbase sparked accumulation speculation. The $56.8 million outflow aligns with $3.51 million in net exchange withdrawals, suggesting institutional interest at current levels.

Binance traders are positioning aggressively long, with a 3:1 long/short ratio reflecting bullish conviction. The $0.805 support level held during Thursday's dip, with ADA rebounding to $0.816 as derivative markets echo spot accumulation trends.

Market structure appears constructive—whale movements, exchange outflows, and derivatives positioning now converge to FORM a unified bullish thesis. Technical traders will watch for sustained closes above $0.80 to confirm this accumulation phase precedes upward revaluation.

Cardano Unveils 2025-26 Roadmap, Bolstering Its Position in Crypto Markets

Cardano (ADA) has solidified its reputation as a blockchain focused on rigorous development, with founder Charles Hoskinson frequently emphasizing enhancements to its transactional and data capabilities. The cardano Foundation recently disclosed a detailed roadmap for 2025-26, signaling ambitious upgrades aimed at scaling adoption and functionality.

Key initiatives include an eight-figure ADA liquidity pool to support stablecoin projects and a 2 million ADA commitment to VentureHub. The blockchain will also prioritize real-world asset (RWA) integrations and Web3 adoption, expanding its team to drive listings and partnerships.

Market observers note the roadmap has amplified bullish sentiment around ADA, with its methodical approach setting it apart from competitors. The foundation's proactive stance on liquidity and infrastructure development underscores Cardano's long-term vision.

How High Will ADA Price Go?

Based on current technical and fundamental analysis, ADA shows potential for a near-term rebound toward initial resistance levels. The oversold technical conditions, combined with strong fundamental developments, create a favorable setup for price recovery.

| Price Target | Probability | Key Drivers |

|---|---|---|

| $0.87-$0.89 | High | Bollinger Band mean reversion, MACD improvement |

| $0.92-$0.95 | Medium | Whale accumulation, roadmap catalyst |

| $1.00+ | Low | Broader market recovery, sustained development momentum |

BTCC financial analyst Mia suggests, 'The $0.79-$0.80 level represents critical support. A hold above this zone could trigger a measured move toward the $0.87-$0.89 resistance area. However, traders should monitor overall crypto market sentiment, as macro factors remain influential.'